In the high-stakes world of wholesale distribution, you don’t get luxury time to react; you need to plan, adjust, and deliver at speed. If you’re managing a wide SKU portfolio, tight margins, and fast-changing demand patterns, then relying on old-school instincts isn’t enough. You need a supply chain planning approach that’s sharp, data-driven, and ready for disruption.

This article walks through the six high-impact strategies that will raise your game, not with fluff, but with real tactics you can implement starting this week.

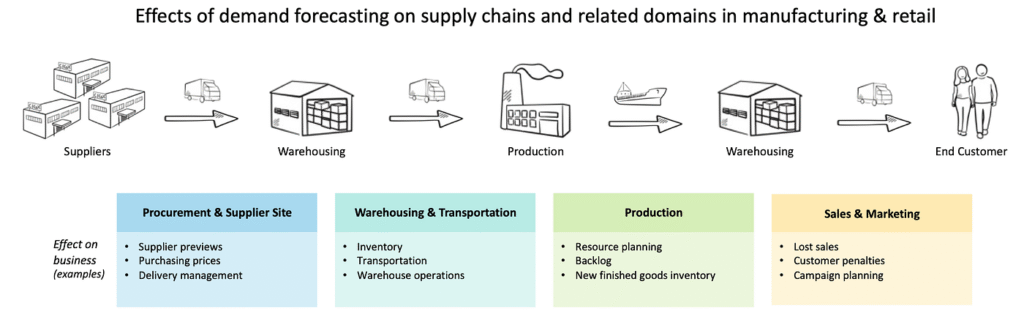

1. Data-Driven Forecasting

Why: Forecasting drives everything: inventory, supplier commitments, logistics. If your forecast is off, it cascades.

What to do:

- Use statistical demand models (e.g., exponential smoothing, ARIMA) and layer in causal inputs like promotions, seasonality, macro signals.

- Shift to a rolling-forecast mindset (weekly or monthly updates) rather than a static annual plan.

- Use ABC/XYZ segmentation; heavy hitters deserve a dedicated forecasting effort; low-volume items may benefit from simpler rules.

- Pull in POS data, customer order patterns, web-traffic signals where relevant for “demand sensing”.

Tip: Make sure you measure forecast bias and accuracy (e.g., MAPE) and feed that back into your models.

2. Dynamic Safety Stock & Reorder Logic

Why: Under-stock means lost sales, over-stock means working capital lock-up. The sweet spot is dynamic, not fixed.

What to do:

- Move away from “fixed number of units” safety stock and toward service-level-based buffers that adjust by SKU demand variability and lead-time risk.

- For multi-location networks, apply multi-echelon inventory optimization (MEIO) logic.

- Measure supplier lead-time variability, freight transit risk and factor into your safety stock.

- Review these parameters at least monthly (in a fast-moving business you can’t “set and forget”).

3. Supplier & Lead Time Management

Why: Your plan is only as solid as your suppliers’ reliability and lead-time integrity.

What to do:

- Track supplier KPIs: On-Time, In-Full (OTIF), lead-time variance.

- Where feasible, build collaborative replenishment with strategic suppliers: share your forecasts, PO pipeline visibility.

- For imported or long-lead items: calculate total landed lead time (ex-factory → transit → customs → DC) and use that in your planning formula.

- Dual-source or near-shore critical SKUs if supply risk is high.

4. Integrated Sales & Operations Planning (S&OP)

Why: You can’t optimize in silos. Demand, supply, finance, operations must align.

What to do:

- Run a monthly S&OP loop: demand review → supply review → pre-S&OP meeting → executive decision meeting.

- Use scenario planning: “What if demand increases 20% this quarter?”, “What if supplier lead time slips 2 weeks?”

- Align your supply-chain metrics with business financial metrics: working capital, margin, profitability.

5. Inventory Segmentation & Prioritization

Why: You have limited working capital. You need to invest where it moves the business.

What to do:

- Apply Pareto: 20% of SKUs often generate 80% of revenue. Focus premium planning rigor there.

- Classify demand patterns (smooth / erratic / intermittent / lumpy) and apply the right planning method to each.

- For slow-moving or non-core SKUs: consider drop-ship, vendor managed inventory, or make-to-order models rather than full stocking.

6. Digital & Process Automation

Why: Manual planning is slow, error-prone, and doesn’t scale.

What to do:

- Automate PO generation where your demand & supply rules permit it.

- Invest in planning tools (cloud platforms, AI/ML (Artificial Intelligence/Machine Learning), forecasting, anomaly detection, so your team spends time on decision-making, not data crunching.

- Integrate real-time visibility (inventory, shipments, supplier updates) so you can detect deviations and respond fast.

7. Performance Tracking & Continuous Improvement

Why: If you don’t measure, you won’t improve.

Key KPIs to monitor:

- Fill rate / service level

- Forecast accuracy (MAPE / Bias)

- Inventory turns & Days of Supply

- OTIF (On‐Time, In‐Full)

- Planner productivity (SKUs per planner, PO cycles reduced)

What to do: Run weekly dashboard reviews, monthly root-cause analysis of misses, and use the findings to refine your forecasting rules, reorder logic, supplier scorecards.

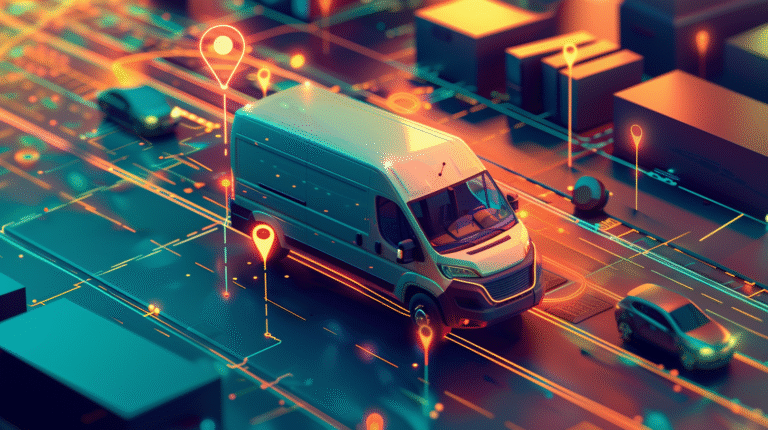

8. Agility & Cross-Functional Coordination

Why: Disruptions are inevitable. How fast you respond separates winners from laggards.

What to do:

- Establish rapid response protocols: cross-functional team (supply-planning, logistics, customer service) that can mobilize within 24 hours of a disruption.

- Align the rhythm of planning: demand sensing, supply flex-plans, alternate sourcing options, contingency inventory buffers.

- Foster alignment between operations and customer service so that trade-offs (cost vs service) are visible and managed consciously.

Conclusion & Next Steps

Running a high-velocity wholesale distribution supply chain is complex — but the right planning approach turns complexity into competitive advantage rather than chaos. If you implement the strategies above, you’ll improve service levels, reduce excess inventory, free up working capital, and build resilience for whatever comes next.

Immediate Actions You Can Take:

- Pick one SKU-segment (e.g., top 20% revenue SKUs) and apply a rolling-forecast + dynamic safety stock model this month.

- Run your next S&OP meeting with two “what-if” scenarios prepared and force cross-functional discussion.

- Audit supplier lead-time variance over the last 12 months and identify which suppliers to score or collaborate with more tightly.

Frequently Asked Questions

Q: What is supply chain planning optimization?

A: Supply chain planning optimization is the process of improving demand forecasting, inventory management, and distribution efficiency using data, automation, and analytics.

Q: Why is supply chain optimization important for wholesale distribution?

A: It helps distributors reduce stockouts, improve fill rates, lower carrying costs, and respond faster to changing market demand.

Q: What tools are used for supply chain planning optimization?

A: Common tools include Kinaxis, o9, Netstock, and Anaplan, which support AI-driven forecasting and dynamic safety stock planning.